What is Demat Account & how to open it? How to choose best broker?

You must have heard that if you want to invest in equity, it is better to take the mutual fund / SIP route rather than do it directly via stocks. However, the numbers of retail investors has increased during this lockdown period wanting to take advantage of the crisis in Quality stocks of stock market this year.

According to recent reports, about 12 lakhs fresh demat

accounts were opened alone in the March-April 2020 with CDSL. Online stock

brokerage firm Zerodha’s chief executive Nithin Kamath shared that his firm

alone has added a record new 3 lakhs demat accounts in this two months in which

65% figure are all new & first time investors.

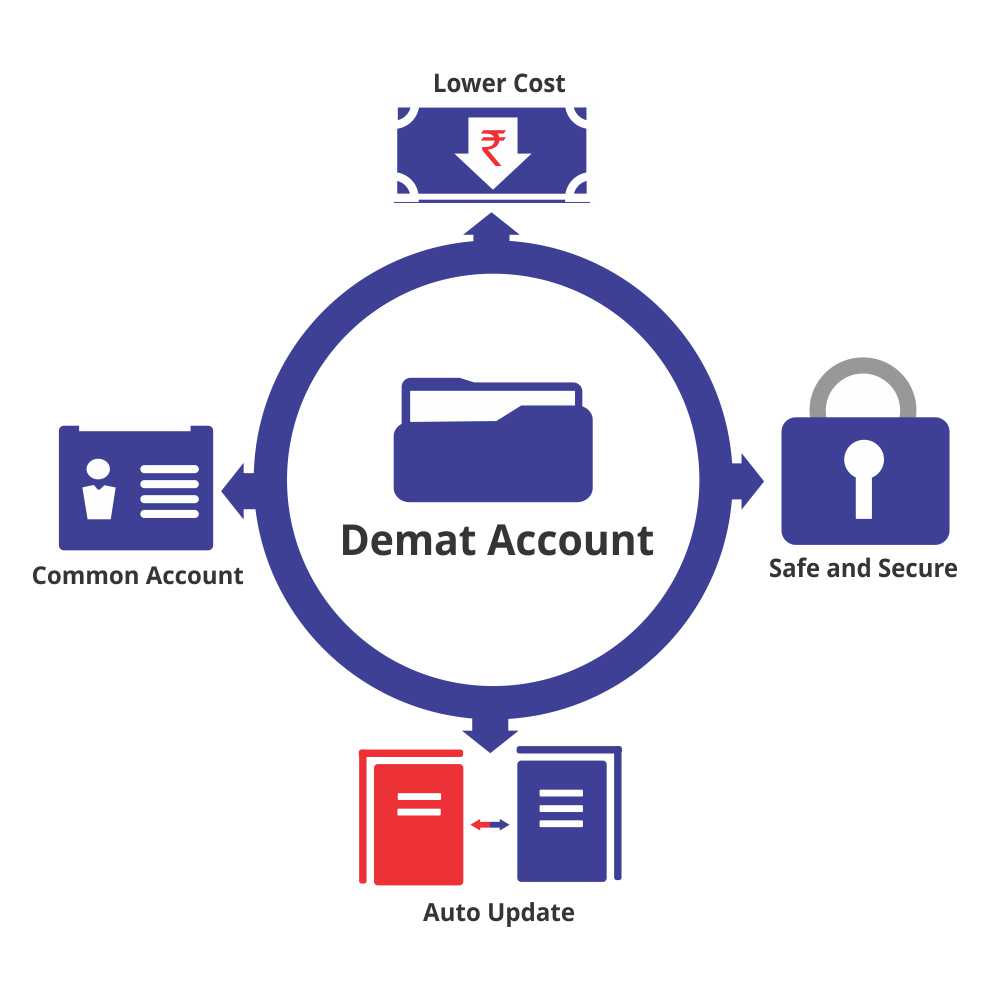

What is a Demat account?

Like an savings account is for depositing money. similarly a demat account is for depositing Shares / Securities in digital form. why digital form? So before the dematerialization of shares they were used in paper form. which is having many disadvantages like secure keeping, easy alterations as in paper format, time consuming for buy / sell of shares, etc. So government decides to digitize the securities.

Types of brokers:

To invest online, one needs a broking account which can be opened by approaching any of the brokerages such as HDFC Securities, ICICI Direct, Axis Direct, Fyers, Zerodha, 5paisa, etc.These broking firms can either be a discount broker or a service broker. The primary difference between the two is the range of products and services that are offered. A discount broker just carries out an investor's trading instructions and has equity and derivatives to offer, where as a service broker, in addition to what a discount broker offers, provides seamless investing options for initial public offerings (IPOs), mutual funds, and insurance on its platform. It is the service broker that comes with research reports on various stocks and sectors. Majority of the broking firms are service brokers.

Opening of accounts:

For investing, you need to have these three in place - a bank account, a trading account and demat account. A demat account is a close cousin of the trading account, without which the demat account is merely a store for holding securities in digital form same as you deposit money in your banks savings account they are not physically in the account but you can transact any time you want. Through a trading account, you can invest in stocks, IPOs, mutual funds and even gold, and hold them in a demat account.The securities in the demat account are held by the depositary participant (DP). There are two DPs - National Securities Depository Ltd (NSDL) and the Central Depository Services India Ltd (CDSL). The DP that will hold your demat account will depend on which one your broking firm has tied up with. There is not much of a difference, anyway, between the services of the two DPs.

You can open a brokerage

account online. "One can open a trading and demat account online and get

started but you will need to sign the Power of Attorney (POA) now a days this

all process is done online including digital signature. This is as per the

regulatory guidelines which can change in the future. Also, the Aadhaar Card is

a very important mandatory document if you want to open an online demat account.

For opening a demat account with any broker you

can follow simple steps as given by the broker and for guidance can call them anytime.

It’s very easy process it’s like signing in any app.

Note *Choose only SEBI (securities & exchange board India)

registered brokers as many frauds are there in market*

Fund flow in Demat account:

1. You transfer funds from your bank savings account to the

trading account.

2. From the trading account, which will have its own unique ID,

one can trade, i.e., buy or sell the shares / securities.

3. The actual credit of shares is shown in the

demat account. The demat account is used as a bank where shares bought are

deposited, and where shares sold are taken from.

Having trading and demat accounts in one place:

Does having a trading and demat account with the same institution help? What happens if it is not with the same entity? "For seamless trading, having a 3-in-1 demat account helps. For instance, if you open a savings account and demat account with ABC Bank and trading account with XYZ Broking house, you are required to transfer the amount to the XYZ bank / broking house from savings account. So if you have the account with same entity you can save your time missing an opportunity. However its not that time consuming also its an easy process.

Charges:

As with any financial service, the fees and broking charges play an important role while selecting a broker. In addition to the opening fees and the annual maintenance fee, which the brokers sometimes waive off, the transaction charges are most critical. "While opening a brokerage account, be aware of the various one-time and recurring charges. You also need to be aware of transaction charges which can vastly differ between brokers. Most brokers charge different fees for different segments which can be quite confusing. Ideally, you should choose a broker that charges a flat fee for all types of transactions. This helps you focus on trading/investing rather than calculating your fees every single time you transactDo keep in mind that you will

be paying for every buy and sell transaction. So, base your decision on whether

you are going to trade very often or buy and stay invested for a longer

duration. (As a retail investor, it is advisable to invest rather than to

trade.) Broking companies have various kinds of pricing plans on offer for

equity investments.

Select the plan that suits

your requirement. The most basic one is the flat pricing plan. In this plan,

irrespective of the volume of the trade, the brokerage remains the same. The

other is the volume-linked pricing in which the brokerage keeps coming down as

volume of trade goes up above a certain limit. It suits those who trade around

that threshold limit. For example, if the value of trade is less than Rs 25

lakh in a year, the brokerage could be 0.75 percent, and for a higher amount it

would drop down to 0.5 percent of the value transacted. Some also offers

pre-paid pricing in which the brokerage gets paid upfront by the customer, who

will in turn get discounted rates on broking transactions. For traders, most

brokerages offer special pricing based on floating funds and trading volume.

Documentation

No comments